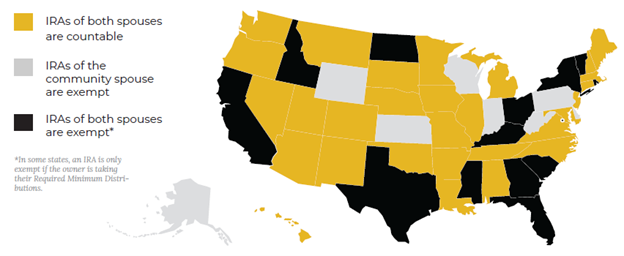

Are IRAs Countable or Exempt for Medicaid?

Since IRAs are very common among seniors, it’s vital to understand how these accounts are treated for Medicaid purposes. Depending on the state, IRAs belonging to the institutionalized person or their spouse may be considered either countable or exempt. Fortunately, if your client’s IRA is treated as a countable asset in their state, they can spend down the account by transferring the funds to a Medicaid Complaint Annuity (MCA).

IRA Treatment as Countable or Exempt by State

Read More: How to Use the “Name on the Check Rule” for Medicaid Planning with IRAs

Consequences of Liquidating an IRA

Traditional IRAs contain pre-tax funds and funds are taxed upon withdrawal, which means liquidating the account can result in hefty tax consequences, including:

- All funds count as taxable income in the year of receipt.

- The account holder may be subject to a higher income tax bracket.

- If a married couple’s total income for the year exceeds $44,000, up to 85% of their Social Security benefits become taxable.

- If a married couple’s total income for the year exceeds $206,000 (in 2024), their Medicare Part B and Part D premiums will increase.

Transferring IRA Funds to an MCA

If your client’s IRA is considered countable for Medicaid purposes, they can fund the account into a Medicaid Compliant Annuity using either a Trustee-to-Trustee Transfer or a 60-Day Rollover. In order to avoid immediate tax consequences, the ownership of the IRA must remain the same.

Trustee-to-Trustee Transfer

A Trustee-to-Trustee Transfer takes place directly between plan administrators. Along with the MCA application, the account owner fills out authorization paperwork for the transfer, and the insurance company issuing the MCA obtains the funds directly from the custodian company.

- Custodians handle the transfer.

- May take four to six weeks

- No time limit for completion

- The client does not receive a 1099-R.

- The client does not receive Form 5498.

- No limit on the number of transfers

60-Day Rollover

To complete a 60-Day Rollover, the account owner contacts the IRA custodian company and initiates a complete liquidation of the account without withholding any taxes. The account owner then receives the liquidation check and must reinvest the funds into a tax-qualified MCA within 60 days to avoid immediate tax consequences. An individual is limited to one rollover per 365-day period.

- The client handles the transfer.

- May take less than four weeks

- 60-day time limit for completion

- The client receives a 1099-R.

- The client receives Form 5498.

- Limit of one rollover per 365-day period

Taxation of IRA Funds

Since contributions to a traditional IRA are made pre-tax, the funds are taxed upon withdrawal or liquidation. Transferring the IRA to an MCA spreads out the tax consequences over the entire annuity term, since the taxation occurs in the year each payment is made rather than all at once. Therefore, the longer the MCA term, the greater the economic benefit for the client.

As Content Marketing Specialist, Katie drafts and edits content across multiple platforms, including blogs, emails, white papers, videos, brochures, website pages, and more. She conducts research and gathers up-to-date information to keep our clients well-informed.