Calculating the Monthly Maintenance Needs Allowance When Medicaid Planning for Married Couples

When assisting married clients with Medicaid planning, one of the most common concerns is how to preserve the financial stability of the community spouse. Fortunately, Medicaid includes key spousal impoverishment provisions to protect the healthy spouse who remains in the community. A critical component of these rules is the Monthly Maintenance Needs Allowance (MMNA).

Read More: Understanding the Medicaid Lookback Period and Its Impact on Asset Transfers

What Is the MMNA?

The MMNA is the amount of monthly income the community spouse is entitled to in order to meet their basic living expenses. If the community spouse’s income falls short of this threshold, the institutionalized spouse diverts a portion of their income to bridge the gap—commonly referred to as an “income shift.”

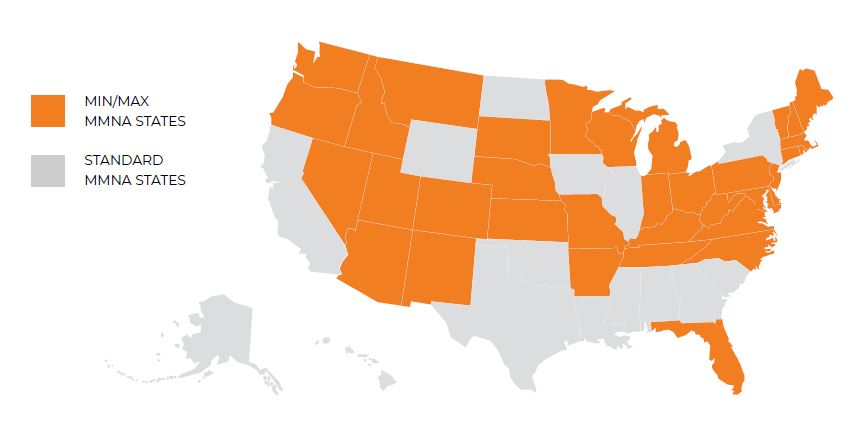

MMNA Approaches: Standard vs. Minimum/Maximum

Standard MMNA States:

Some states use a fixed MMNA. If the community spouse’s income is below this standard, they receive the difference from the institutionalized spouse’s income, dollar for dollar. For instance, if the MMNA is $3,948 and the community spouse earns $2,500, they are entitled to a $1,448 income shift.

Minimum/Maximum MMNA States:

Other states take a more complex approach based on the community spouse’s shelter costs, within a set minimum and maximum MMNA range. The calculation involves determining excess shelter expenses, which are then added to the minimum MMNA. However, the resulting figure cannot exceed the state’s maximum MMNA.

To calculate the MMNA in these states, you’ll need:

- The Standard Utility Allowance (a flat estimate for utility costs)

- The Shelter Standard (a baseline threshold for monthly housing expenses)

- The community spouse’s total monthly shelter costs

Min/Max MMNA Example: Income Shift in Action

Howard recently became eligible for Medicaid, and his wife, Sharon, continues to live at home with a monthly income of $2,300. What is Sharon’s MMNA? How much of an income shift will she receive from Howard each month?

To calculate Sharon’s MMNA, start by adding up her total monthly shelter expenses, which include:

- Mortgage: $1,400

- Property Taxes: $300

- Homeowner’s Insurance: $100

- Standard Utility Allowance: $450

- Total: $2,250

Next, subtract the Shelter Standard, which is $766.50 in this case, from Sharon’s total monthly shelter expenses of $2,250. The resulting figure of $1,483.50 is the excess expenses Sharon is responsible for each month. Then, add the excess expenses to the minimum MMNA, which is $2,555. Since the resulting figure of $4,038.50 is greater than the maximum MMNA of $3,948, Sharon is entitled to the maximum MMNA.

To determine Sharon’s income shift from Howard, subtract her monthly income of $2,300 from her MMNA of $3,948. Sharon is entitled to receive $1,648 from Howard to supplement her monthly income and maintain her lifestyle within the community.

Read More: What Happens If the Owner Passes Away Before the MCA Term Ends?

Why the MMNA Matters for Your Practice

Advising clients on spousal impoverishment rules, including the MMNA, is a vital part of effective crisis Medicaid planning. Properly structuring income shifts not only ensures the community spouse’s financial stability but also helps maintain eligibility for the institutionalized spouse.

If you’d like assistance with a specific case or have questions about MMNA calculations, our team is here to help. Schedule a call with us today to explore how these rules apply to your client’s specific situation.

As Senior Content Specialist, Katie drafts and edits content across multiple platforms, including blogs, guides, emails, white papers, videos, brochures, website pages, and more. She conducts research and gathers up-to-date information to keep our clients well-informed.